north carolina real estate tax records

View GIS Parcel Map. Wayne County Tax Collector PO.

The convenience fee for Electronic Check transactions is 275 for each payment less than or equal to 10000 and 15 for each payment greater than 10000.

. The Registry of Deeds is responsible for maintaining all property records for that county. Box 38 Halifax NC 27839. Box 1495 Goldsboro NC 27533.

You can use this. We have placed a new secure outdoor. The Local Government Division provides support and services to the counties and municipalities of North Carolina as well as taxpayers concerning taxes collected locally by the counties and.

The Real Property Records Search allows the user to obtain. North Carolina has relatively. Durham County Tax Administration provides online Real Property Records Search.

How Many Years Of Tax Records To Keep. A North Carolina Property Records Search locates real estate documents related to property in NC. This site provides read access to tax record information from Onslow County North Carolina.

Wake County Register of. To access this information start by performing a search of the property. Payment drop box located at public North parking lot at courthouse.

Historic Courthouse 10 North King Street Halifax NC 27839. All data is compiled from recorded deeds plats and other public records and data. Buncombe County Tax Dept.

Public Property Records provide information on land homes and commercial properties. How Is South Carolina For Retirement. How High Are Property Taxes In North Carolina.

Tax Administration Records Search. Statements for real estate business and personal property may be printed using our Online Tax Bill Search. Land Records Management Section assists local governments in establishing standards for the indexing and electronic access and storage of vital land records involved in.

Each county in North Carolina has its own Registry of Deeds office. Annual tax bills are calculated for the fiscal taxing period of July 1 through June. Welcome to the NHC Tax Departments Property Assessment Website.

The mission of the Harnett County Tax Department is to provide fair and equitable appraisal assessment billing and collection of taxes on real business and personal property. 94 Coxe Avenue Asheville NC 28801 828 250-4910 or 250-4920. This site provides assessed values and data extracted from the assessment records for residential.

Tax Administration has added another contactless option for making check or money order tax payments and for submitting tax listings and forms. 230 Government Center Drive Suite 190 Wilmington NC. This is a tall silver box.

Payments Please send payments to. All information on this site is prepared for the inventory of real property found within Cabarrus County.

Tax Department Town Of Beech Mountain

Tax Department New Hanover County North Carolina

Tax Department Lenoir County North Carolina Official Website

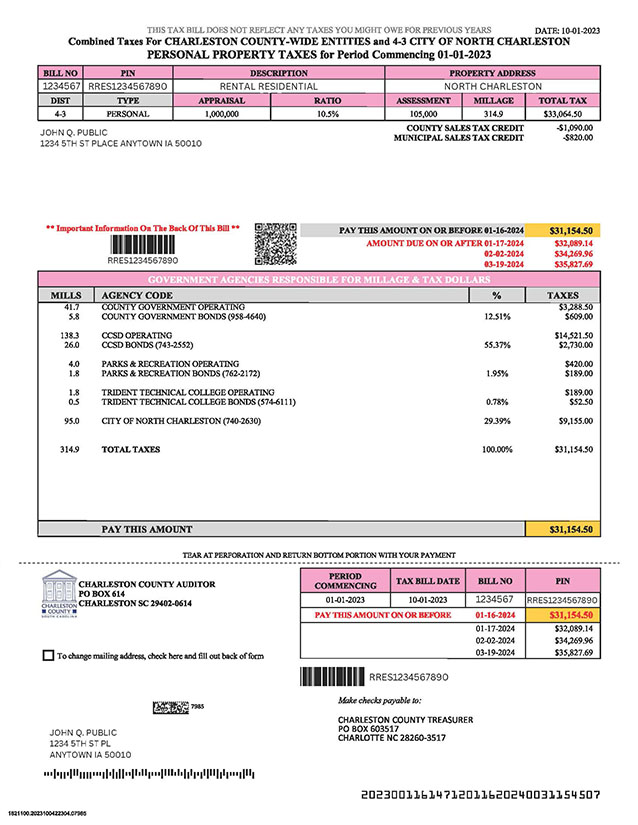

Real Estate Property Tax Data Charleston County Economic Development

Notification And Appeal Process Union County Nc

Real Estate Wake County Government

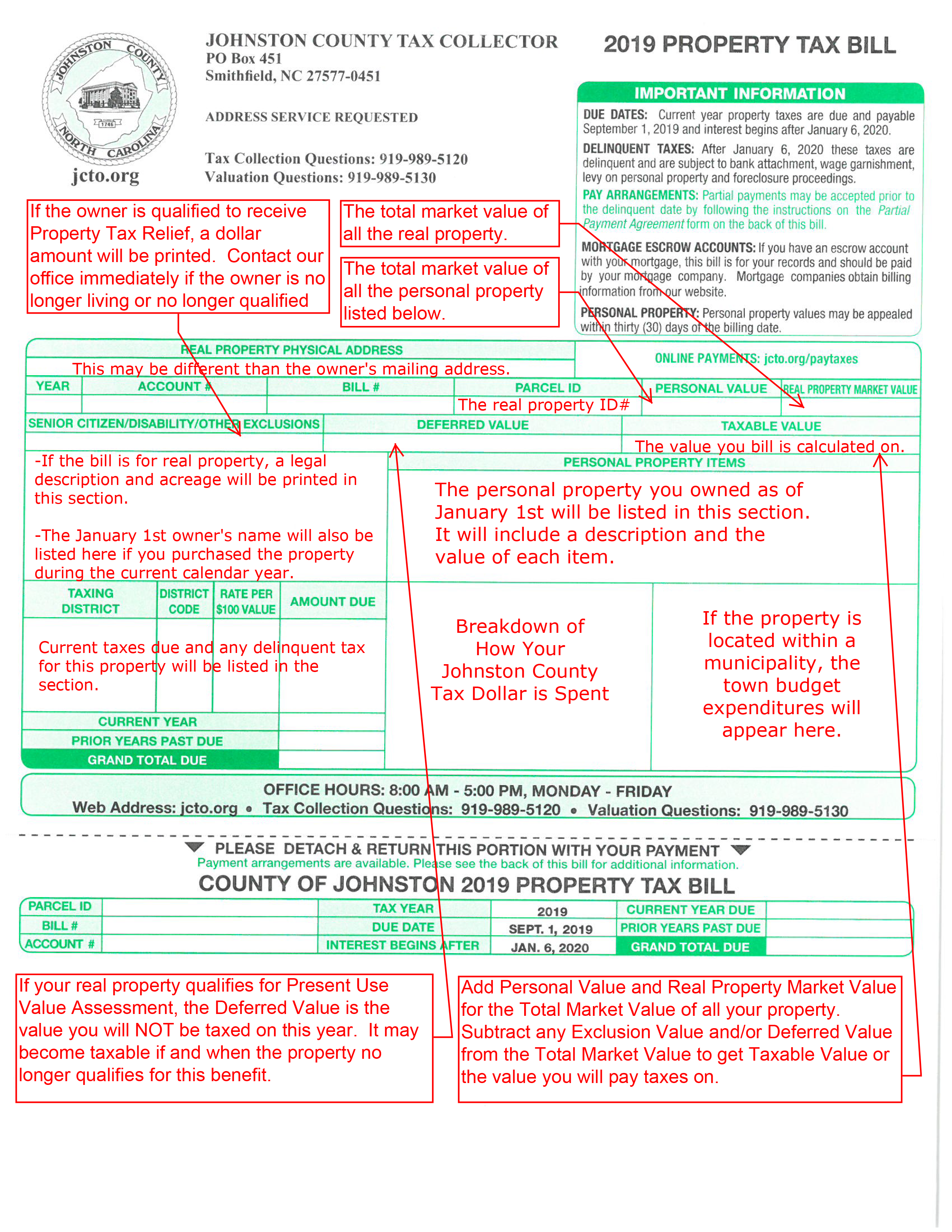

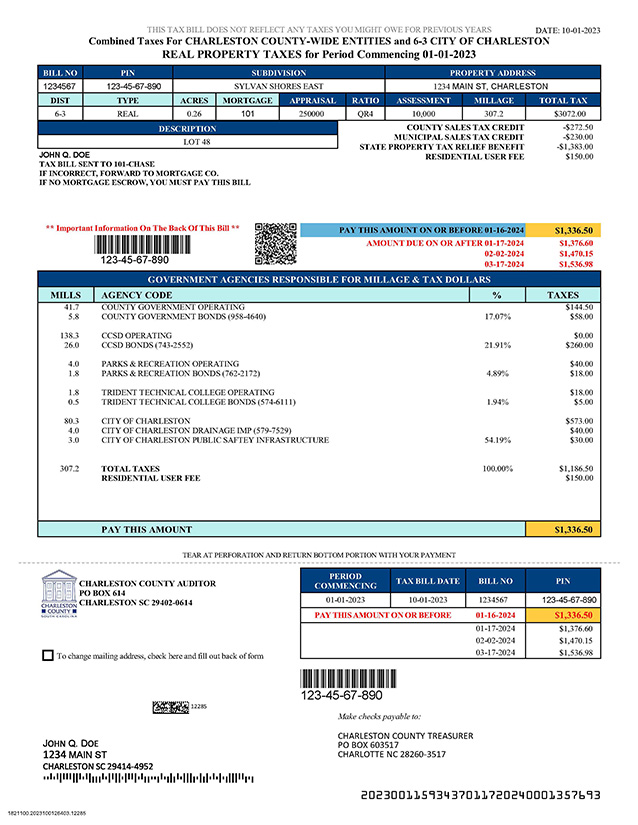

Sample Real Property Tax Bill Charleston County Government

11 Eagle Drive Jackson Springs Nc 27281 Compass

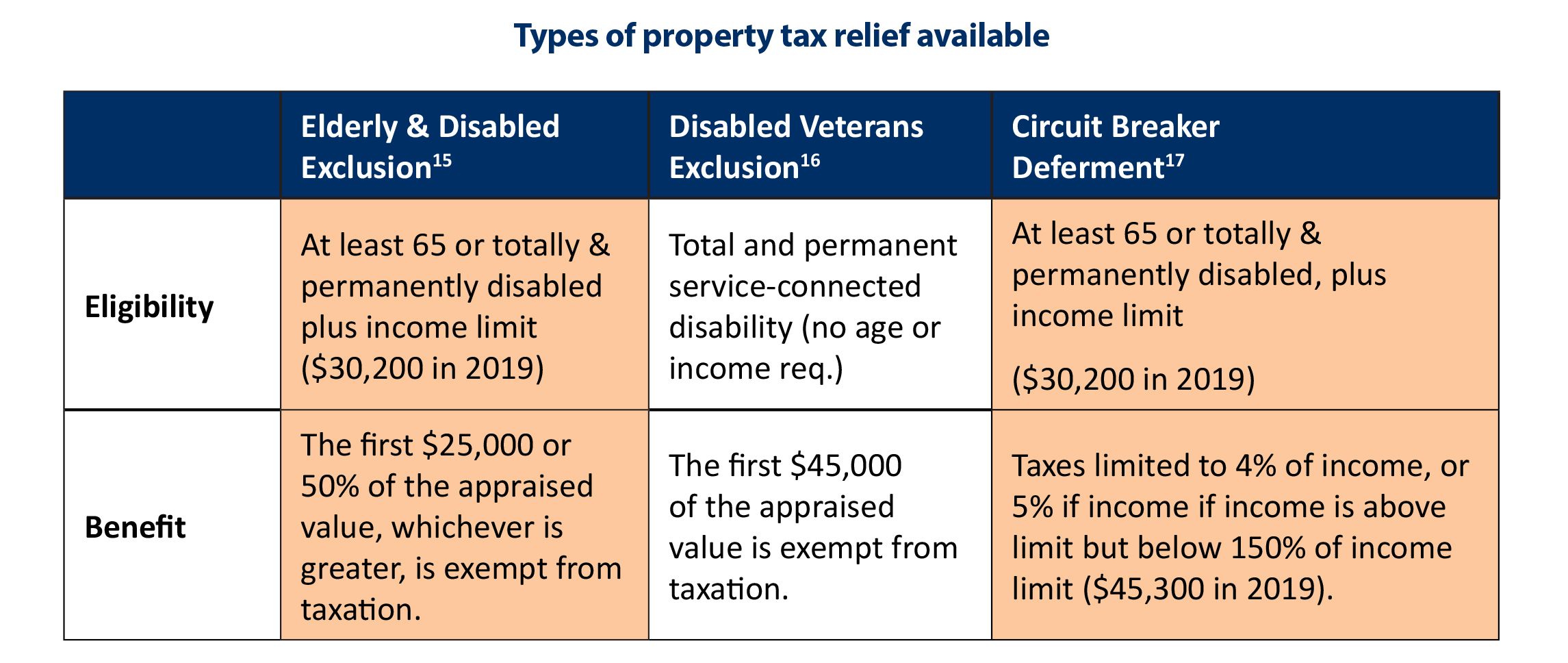

N C Property Tax Relief Helping Families Without Harming Communities North Carolina Justice Center

North Carolina Property Tax Solution Optimize The Property Tax Process North Carolina Association Of County Commissioners

How Taxes On Property Owned In Another State Work For 2022

Sample Real Property Tax Bill Charleston County Government